Medicare Part C, also known as Medicare Advantage, has gained significant popularity as a way for Medicare beneficiaries to receive their health benefits through private insurance companies. These plans are an alternative to traditional Medicare (Part A and Part B) and often include additional benefits like vision, dental, and prescription drug coverage (Part D). Switching between Medicare Part C providers can be complex while offering a wide range of benefits.

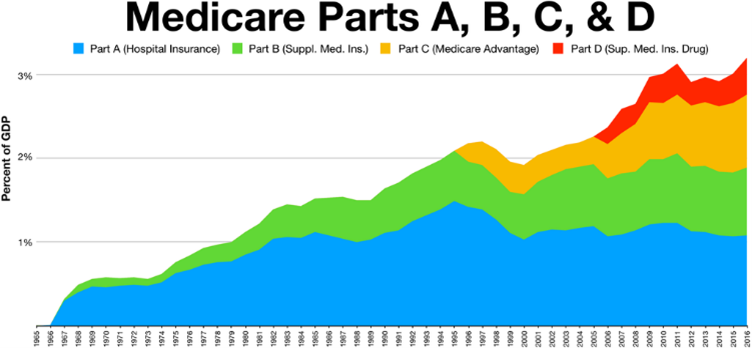

The flood of advertisements seen during the Annual Enrollment Period, or AEP, often raises questions among beneficiaries. Why are there so many ads, and what’s the difference between private Medicare Advantage and public Medicare? We’re going to explore these topics in-depth, helping you understand the landscape of Medicare Part C, why people change providers, and what fuels the barrage of marketing during the enrollment window.

Medicare Part C Explained

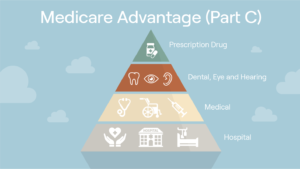

Medicare Part C, or Medicare Advantage, is a type of health plan offered by private insurance companies that contract with the federal government to provide Medicare benefits. These plans must cover all services provided under Medicare Part A and Part B, but they often come with added perks like vision, hearing, dental, and prescription drug coverage. Because they are offered by private insurers, Medicare Advantage plans can differ widely in terms of premiums, co-payments, network restrictions, and additional services offered.

Medicare beneficiaries have the choice of enrolling in traditional Medicare, which is managed by the government, or selecting a Medicare Advantage plan administered by a private insurer. This public vs. private structure is central to understanding the competition, choice, and marketing efforts that characterize the Medicare market, especially during the Annual Enrollment Period.

Why People Change Medicare Part C Providers

Changing Medicare Advantage providers is a common occurrence during the AEP, which runs from October 15 to December 7 each year. During this period, beneficiaries can review their current Medicare Advantage plan and make adjustments, or switch to another plan if they believe it better fits their needs. There are several reasons why someone might choose to change their Medicare Part C provider:

1. Changes in Health Needs

As people age, their healthcare needs often evolve. A plan that once met all a person’s needs may no longer be the best option. For example, a beneficiary might develop a chronic condition requiring specialized care not fully covered by their current plan. Some Medicare Advantage plans provide better coverage for chronic illnesses or offer disease management programs that appeal to those with ongoing health issues. Alternatively, someone who was previously on an expensive plan that catered to extensive healthcare needs may now be in better health and might seek a lower-cost plan with fewer benefits. Switching plans allows beneficiaries to tailor their healthcare coverage to fit their current situation.

2. Provider Networks

Medicare Advantage plans typically operate within a network of doctors, hospitals, and specialists. These networks can change from year to year, potentially leaving a beneficiary without access to their preferred healthcare providers. If a favorite doctor or hospital is no longer part of the plan’s network, or if the network’s geographic area changes, the individual may seek a new Medicare Advantage plan that better suits their preferences or location.

3. Costs

Cost is one of the most significant factors in deciding whether to switch Medicare Advantage providers. While Medicare Advantage plans often have lower premiums than traditional Medicare, they may include higher out-of-pocket costs depending on the plan’s structure. Co-pays, deductibles, and maximum out-of-pocket expenses can vary between plans and might increase from year to year. Beneficiaries who experience rising costs or face unexpected medical expenses may look for a more cost-effective plan.

4. Plan Benefits

Medicare Advantage plans offer benefits beyond what traditional Medicare covers, but the range and depth of these benefits can vary significantly between providers. Some plans may include gym memberships, transportation to medical appointments, or enhanced dental and vision care. If a plan reduces or drops certain perks that a beneficiary finds essential, they may opt to switch to a new provider. The inclusion of prescription drug coverage within some Medicare Advantage plans can also be a deciding factor for those on necessary medications.

5. New Plans and Providers

Each year, new Medicare Advantage plans are introduced, and some may offer better benefits, lower costs, or broader networks than existing ones. Competition among private insurers drives innovation, so beneficiaries often find appealing new options that weren’t available in previous years. Existing plans might expand their coverage areas or adjust their offerings, prompting beneficiaries to switch.

Why You See So Many Ads During Medicare Enrollment

If you’ve ever watched TV, listened to the radio, or browsed the internet during the Medicare Annual Enrollment Period, you’ve likely noticed a deluge of Medicare Advantage ads. These advertisements come from private insurance companies promoting their Medicare Part C plans, and the intensity of this marketing can seem overwhelming. There are several reasons for this surge in ads.

Highly Competitive Market

The Medicare Advantage market is highly competitive. With dozens of private insurers offering a variety of plans, companies must vie for the attention of beneficiaries. Each plan is unique in terms of cost, benefits, and provider networks, so insurers use advertising to differentiate themselves and attract potential customers. Unlike traditional Medicare, where benefits are standardized and there’s little variation, Medicare Advantage plans vary considerably, which makes advertising a crucial tool for insurers. They need to explain their offerings clearly and entice beneficiaries to either switch from traditional Medicare or move from one Medicare Advantage plan to another.

Medicare Advantage Plan Profitability

Private insurers have financial incentives to encourage enrollment in Medicare Advantage plans. The federal government pays these companies a fixed amount per beneficiary, and insurers can earn significant profits by managing healthcare costs while providing coverage. With so much at stake, it’s no surprise that insurers spend heavily on marketing to attract more beneficiaries to their plans.

Limited Timeframe

The AEP runs for just seven weeks each year. This short window means that insurers need to make a big impact in a limited amount of time. As a result, marketing efforts are often concentrated during this period, leading to a significant uptick in TV commercials, mailers, online ads, and even phone calls urging beneficiaries to consider new plans. Since the window to switch or enroll in new plans closes on December 7, companies aim to build urgency among beneficiaries, pushing them to act quickly.

Tailored Advertising

Medicare Advantage advertisements are often highly targeted, using data to ensure that ads reach the right audience. Companies use demographic information, including age and location, to tailor their messaging to those most likely to benefit from a particular plan. This precision in marketing leads to beneficiaries being exposed to a disproportionately large number of ads compared to other types of insurance, particularly during the AEP.

Private vs. Public Insurance

The distinction between private and public insurance is a crucial aspect of the Medicare Advantage landscape. While traditional Medicare Parts A and B are managed by the federal government, Medicare Advantage is operated by private insurers. Let’s break down the key differences between these two models:

Coverage

Traditional Medicare: Provides basic coverage for hospital (Part A) and outpatient services (Part B), but typically doesn’t include prescription drugs, dental, vision, or hearing benefits. Beneficiaries often purchase supplemental plans (Medigap) and a Part D prescription drug plan to cover these gaps.

Medicare Advantage: Offers all the benefits of traditional Medicare, but often bundles in additional services like dental, vision, and hearing, as well as prescription drug coverage. The range of benefits can vary between plans, and some offer extras like fitness programs or transportation services.

Cost Structure

Traditional Medicare: Generally, has higher out-of-pocket costs, including premiums, deductibles, and co-insurance. However, it offers more predictable pricing, and there are no network restrictions.

Medicare Advantage: Often features lower premiums but can come with higher out-of-pocket costs when services are used. Most Medicare Advantage plans operate within a network, which can limit choice but may reduce costs.

Flexibility

Traditional Medicare: Offers flexibility in choosing healthcare providers, as beneficiaries can see any doctor or specialist that accepts Medicare.

Medicare Advantage: Typically restricts access to a network of doctors and hospitals. Beneficiaries may need referrals to see specialists, and out-of-network care may be more expensive or not covered at all.

Management

Traditional Medicare: Managed by the federal government, with consistent benefits across the country.

Medicare Advantage: Managed by private companies, which means plans can vary by provider and location.

Dangers of Medicare Advantage

Medicare Advantage plans are private alternatives to traditional Medicare, often offering extra benefits like dental, vision, and prescription coverage. However, there are several potential dangers to consider. First, limited networks can be a major issue. Unlike traditional Medicare, which allows beneficiaries to see any doctor or specialist that accepts Medicare, Medicare Advantage plans often restrict access to specific healthcare providers. This can be particularly problematic if a preferred doctor or specialist is not included in the network.

Another risk is prior authorization requirements. Many Medicare Advantage plans require prior approval for certain treatments, medications, or services, leading to delays in care or outright denials. This can limit timely access to necessary medical treatments.

Cost unpredictability is another concern. While premiums may be lower, out-of-pocket costs for deductibles, co-pays, and co-insurance can add up, particularly for individuals with chronic conditions requiring frequent care. These costs can quickly surpass those of traditional Medicare and become a major concern for anyone living on a fixed income.

The quality of care may also suffer. The incentives for insurers to minimize expenses could lead to under-provision of care. In some cases, beneficiaries might face denials of essential services that traditional Medicare would cover. This is something that always needs to be at the forefront of your mind when deciding to go with private insurance over public.

Why Captain Kirk is Selling Insurance

When you’re seeing all the ads for Medicare Advantage, take a minute to think about why celebrities like William Shatner are trying to sell it to you and what that means to your health. Medical insurance companies use celebrity endorsements for several strategic reasons. The key goals are:

- Building Trust and Credibility: Celebrities, especially those perceived as trustworthy or relatable, can help build a sense of credibility for the insurance company. When people see a familiar face endorsing a brand, they may feel more comfortable and confident in choosing that insurer.

- Increasing Brand Awareness: Celebrities have large followings and influence, so their endorsements can significantly increase the visibility of the insurance company. By associating with well-known figures, insurers can reach a wider audience, especially if the celebrity has a broad or specific demographic appeal.

- Creating Emotional Connections: Celebrities often evoke emotional responses from their fans. When they share personal stories related to health or insurance, such as recovering from a medical condition, it helps the audience connect emotionally with the brand and its services.

- Differentiating from Competitors: In a crowded market, insurance companies use celebrity endorsements as a way to stand out. The endorsement can create a unique association between the celebrity and the brand, which may help consumers remember that particular company over its competitors.

- Targeting Specific Demographics: Celebrities can be selected based on their appeal to specific groups. For example, an older celebrity might appeal to seniors looking for Medicare supplements, while a younger, athletic celebrity might attract a more health-conscious, younger audience.

- Humanizing the Brand: Insurance is often seen as a complex or impersonal industry. By using celebrities, companies can humanize their brand, making it more relatable and approachable to potential customers.

By leveraging these elements, insurance companies hope to influence buying decisions and cultivate loyalty. While this is reasonable when it comes to selling toilet paper or cars, it has an air of immorality when it comes to your health. All people must decide if they believe their medical decisions should be influenced by actors and athletes. It also shows that the private companies offering the insurance stand to make lots of money off you. The question is whether or not you believe they have your best interest in mind when you’re seen as a profit, not a patient.

Understand the Difference

Understanding the difference between public Medicare and private Medicare Advantage is crucial when making these decisions. Beneficiaries need to weigh the costs, benefits, and flexibility of each option before deciding to stick with their current plan or switch to a new one. The choice between private and public insurance ultimately depends on personal healthcare needs, financial circumstances, and preferences for provider networks. These are the key differences between Medicare and Medicare Advantage. We’ll get into other areas in the next installment. Make sure you check back so you get the full picture of what’s really going on!