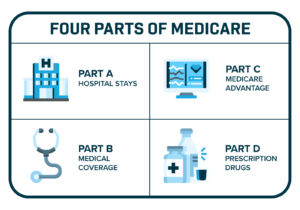

Medicare Advantage, also known as Medicare Part C, is a popular alternative to Original Medicare Part A and Part B. It offers more comprehensive health coverage by combining traditional Medicare benefits with additional services like prescription drug coverage, dental care, vision, and wellness programs. With more than 31 million Americans enrolled in Medicare Advantage plans as of 2024, it’s crucial to understand what it is, how it works, and how it compares to traditional Medicare.

This final part of our Medicare series delves into the essentials of Medicare Advantage, explaining its benefits, costs, and types of plans to help you make an informed decision about your healthcare coverage.

What is Medicare Advantage?

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare Part A and Part B and often include additional services not covered by traditional Medicare. This could include prescription drug coverage, routine dental and vision care, hearing aids, and wellness programs like gym memberships.

Unlike Original Medicare, which is managed by the federal government, Medicare Advantage plans are overseen by private insurers. These insurers receive a fixed payment from Medicare to provide beneficiaries with their healthcare services.

How Medicare Advantage Works

Medicare Advantage plans operate similarly to private health insurance. Enrollees typically pay monthly premiums and may face other out-of-pocket costs like copayments, deductibles, and coinsurance. In return, beneficiaries receive comprehensive healthcare coverage that often goes beyond what Original Medicare offers.

While all Medicare Advantage plans must cover at least the same benefits as Original Medicare, the specific coverage and cost-sharing structures can vary. Some plans may offer low or no premiums but charge higher out-of-pocket costs. Others may have a higher monthly premium but offer lower copayments and more extensive benefits.

Eligibility for Medicare Advantage

To enroll in a Medicare Advantage plan, you must:

- Be enrolled in both Medicare Part A and Part B.

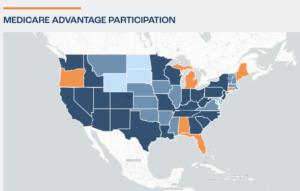

- Live in the plan’s service area.

- Not have end-stage renal disease, or ESRD, although exceptions now apply due to recent policy changes.

Once enrolled, beneficiaries typically receive their healthcare through a network of doctors and hospitals associated with the plan, much like traditional health insurance plans.

Types of Medicare Advantage Plans

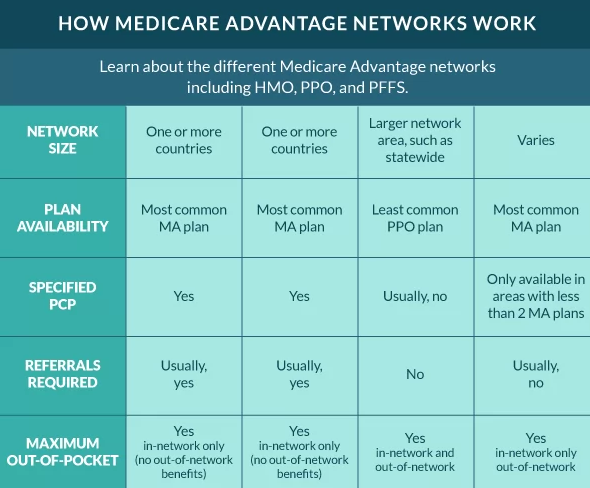

Medicare Advantage comes in several forms, allowing beneficiaries to choose the type of plan that best fits their needs. Here are the most common types:

- Health Maintenance Organization: HMO plans require members to use a network of healthcare providers. These plans usually require referrals for specialist visits and may not cover out-of-network services except in emergencies.

- Preferred Provider Organization: PPO plans allow enrollees to see providers outside of their network but at a higher cost. Referrals are not required for specialists, providing more flexibility than HMO plans.

- Private Fee-for-Service: PFFS plans determine how much they will pay healthcare providers and how much members will pay for care. You can typically visit any provider that agrees to accept the plan’s payment terms.

- Special Needs Plans: SNPs are designed for individuals with specific diseases or characteristics. These plans often offer tailored benefits, provider choices, and drug formularies.

- Medicare Medical Savings Account: MSA plans combine a high-deductible health plan with a medical savings account. Medicare deposits money into the savings account that beneficiaries can use to pay for their healthcare expenses before the deductible is met.

Medicare Advantage vs. Original Medicare

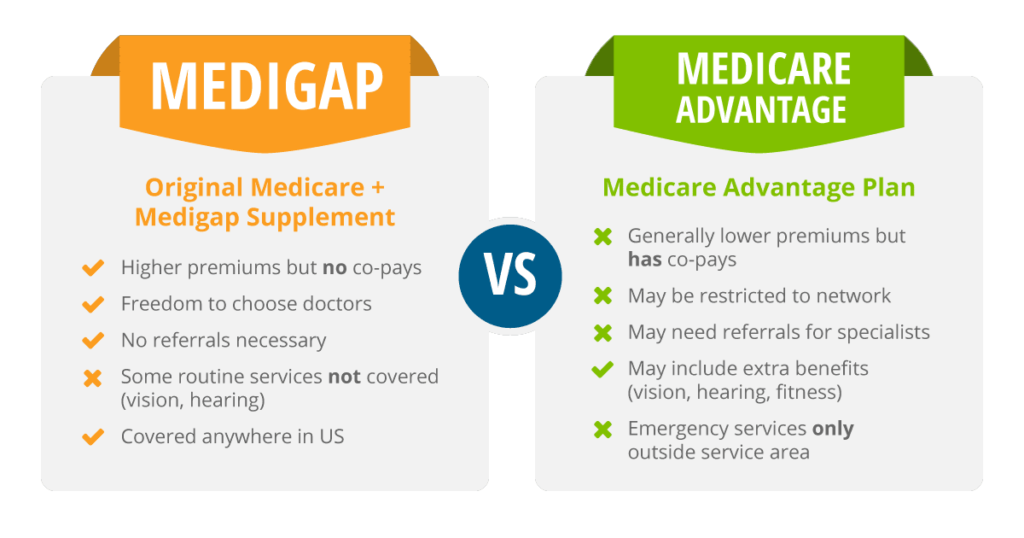

Understanding the difference between Medicare Advantage and Original Medicare is essential in making the right healthcare decision. While both provide important health services, they have distinct advantages and limitations.

Coverage

- Medicare Advantage: Includes the same benefits as Original Medicare and may offer extra services like vision, hearing, dental, and prescription drug coverage.

- Original Medicare: Does not include extras like dental, vision, or hearing aids unless you purchase supplemental insurance like Medigap.

Cost

- Medicare Advantage: Often includes lower premiums than Medigap and Original Medicare, but out-of-pocket costs can vary widely depending on the specific plan.

- Original Medicare: Offers standardized coverage but comes with higher out-of-pocket costs, which can be supplemented with Medigap insurance.

Flexibility

- Medicare Advantage: Tends to have networks of doctors and hospitals, limiting flexibility. You may need referrals to use specialists.

- Original Medicare: Allows you to visit any healthcare provider in the U.S. that accepts Medicare, providing maximum flexibility.

Prescription Drug Coverage

- Medicare Advantage: Most plans include Medicare Part D prescription drug coverage.

- Original Medicare: Requires a separate purchase of a Medicare Part D plan to cover prescription medications.

Costs Associated with Medicare Advantage

- The costs of Medicare Advantage plans can vary widely depending on your location, the insurer, and the plan you choose. Here are the major costs you need to consider:

- Monthly Premiums: Most Medicare Advantage plans have a monthly premium in addition to the Part B premium. Some plans, however, offer a $0 premium option.

- Deductibles: You may have to pay deductibles for medical services or prescription drugs, depending on the plan.

- Copayments/Coinsurance: This is the amount you pay for each medical service, such as doctor visits or hospital stays. Copayments can vary between plans and are often lower than those for Original Medicare.

- Out-of-Pocket Maximum: Medicare Advantage plans are required to set an annual out-of-pocket maximum, which limits how much you will pay in a given year for covered services. Once you reach this maximum, your plan covers 100% of your medical expenses for the remainder of the year.

Advantages and Disadvantages of Medicare Advantage

Like any health insurance plan, Medicare Advantage has both benefits and drawbacks. Here’s a summary of its pros and cons.

Pros

- Comprehensive Coverage: Medicare Advantage plans often cover services not included in Original Medicare, such as dental, vision, and wellness programs.

- All-in-One Plan: With Medicare Advantage, you get hospital, medical, and often prescription drug coverage under one plan.

- Annual Out-of-Pocket Maximum: Unlike Original Medicare, Medicare Advantage plans have a cap on how much you’ll spend out-of-pocket in a year.

Cons

- Limited Provider Networks: Most plans require you to use a network of doctors and hospitals, and going out-of-network can lead to higher costs.

- Varied Costs: Out-of-pocket costs can vary significantly between plans, making it essential to compare options carefully.

- Need for Referrals: Some plans, especially HMOs, may require you to get referrals for specialist care, limiting flexibility.

Choosing the Right Medicare Advantage Plan

Selecting the right Medicare Advantage plan requires careful consideration of your healthcare needs, budget, and provider preferences. Evaluate your healthcare needs and consider whether you need additional services such as dental or vision care. If you take prescription medications, look for a plan that includes Medicare Part D coverage.

Compare costs and review the plan’s premium, deductible, and copayment structure. Make sure to calculate your estimated out-of-pocket expenses, not just the monthly premium. Then check the Provider Network. If you have preferred doctors or hospitals, check if they are included in the plan’s network. Going out of network could result in higher costs. Then consider the plan’s star rating. Medicare assigns star ratings to Medicare Advantage plans based on factors such as customer satisfaction, plan performance, and health outcomes. A plan with a high star rating is generally a safer bet. Finally, look for special needs plans. If you have a chronic condition, you may benefit from a Special Needs Plan, which provides specialized coverage tailored to your specific healthcare needs.

The Takeaway

Medicare Advantage offers a compelling alternative to Original Medicare, especially for those seeking additional benefits like dental, vision, or prescription drug coverage. However, it’s important to consider the costs, network limitations, and the potential need for referrals. By carefully comparing Medicare Advantage plans and considering your healthcare needs, you can find the plan that offers the right combination of benefits and affordability. Remember that choosing the right Medicare Advantage plan is not just about monthly premiums but also out-of-pocket expenses, network access, and covered services. Make sure to do your research and choose a plan that aligns with your healthcare needs and financial situation.

We’ve tried to simplify the whole process as much as possible, but don’t be surprised if some confusion remains. Medicare is one of the country’s biggest expenditures and, as such, it’s complicated beyond measure. If you need more information, visit the official Medicare website or consult with a licensed insurance advisor to explore your options. Just make sure you understand it as best you possibly can before you make a decision. Captain Kirk isn’t going to cover your out of pocket expenses for you, even though he’s the one trying to convince you that you need it!