Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful and influential investors of all time. Born in 1930, Buffett has become a symbol of financial wisdom and a model for long-term investing. This biography explores his life, career, and the principles that have guided him to become a billionaire and a beloved philanthropist who months ago reached the age of 94.

Early Life and Influences

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska, to Howard and Leila Buffett. His father was a stockbroker and a U.S. Congressman, which exposed the young Warren to the world of finance from an early age. Even as a child, Buffett showed an aptitude for numbers and business. He was known to calculate large columns of numbers in his head and demonstrated an early interest in investing.

Buffett’s entrepreneurial spirit was evident even in his childhood. At the age of six, he purchased six-packs of Coca-Cola from his grandfather’s grocery store for $.25 and sold each bottle for $.5, making a profit of $.5/pack. This was his first experience with the concept of margin and profit, which would become central to his investment philosophy.

Education and Early Career

Buffett’s academic career was impressive but unconventional. He attended the Wharton School of the University of Pennsylvania in 1947, but he transferred to the University of Nebraska two years later. He completed his degree there and then applied to Harvard Business School, where he was rejected. This setback led him to enroll at Columbia Business School, where he met two of the most important influences in his life: Benjamin Graham and David Dodd.

Benjamin Graham, known as the father of value investing, had a profound impact on Buffett. Graham’s philosophy of investing in undervalued stocks with a margin of safety became the cornerstone of Buffett’s investment strategy. Buffett was so impressed with Graham that he offered to work for him for free. Graham initially declined but eventually hired Buffett at his firm, Graham-Newman Corp., in 1954. This experience solidified Buffett’s approach to investing and laid the foundation for his future success.

Buffett Partnership, Ltd.

In 1956, at the age of 26, Buffett returned to Omaha and started his own investment firm, Buffett Partnership, Ltd. With $100,000 from a group of friends and family, he began managing money with the principles he had learned from Benjamin Graham. Buffett was meticulous in his research and analysis, looking for undervalued companies with strong potential.

The partnership was highly successful. Buffett achieved an average annual return of 29.5% over a span of 13 years, significantly outperforming the Dow Jones Industrial Average, which had an average return of 7.4% during the same period. By the time he dissolved the partnership in 1969, Buffett had amassed a personal fortune of $25 million.

Acquiring Berkshire Hathaway

One of the most significant decisions in Buffett’s career was the acquisition of Berkshire Hathaway, a struggling textile manufacturing company. In 1962, Buffett began buying shares of Berkshire Hathaway, initially intending to make a short-term profit. However, after a disagreement with the company’s management, Buffett took control of the company in 1965.

While the textile business continued to decline, Buffett saw Berkshire Hathaway as a holding company that could be used to acquire other businesses. Over time, he transitioned Berkshire from a textile company into a diversified conglomerate with interests in insurance, utilities, manufacturing, retail, and more. This transformation turned Berkshire Hathaway into one of the largest and most successful companies in the world.

Investment Philosophy and Strategy

Warren Buffett’s investment philosophy is deeply rooted in the principles of value investing. He seeks to buy quality companies at reasonable prices and hold them for the long term. Buffett’s approach is characterized by his focus on businesses with strong fundamentals, such as a durable competitive advantage, competent management, and consistent earnings power.

One of Buffett’s most famous investment principles is to buy companies with a “moat,” a metaphor for a competitive advantage that protects a company from competitors. He looks for businesses with strong brands, economies of scale, or unique products that give them a sustainable edge in the market.

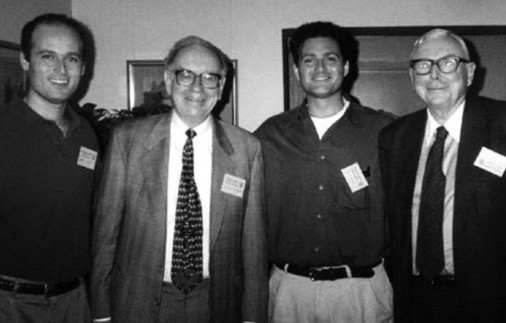

Buffett also emphasizes the importance of management. He prefers to invest in companies with honest and capable leaders who are committed to maximizing shareholder value. His long-standing partnership with Charlie Munger, vice-chairman of Berkshire Hathaway, has been instrumental in shaping his investment decisions. Together, they have adhered to a disciplined approach, avoiding the temptations of short-term speculation.

Major Investments and Acquisitions

Over the years, Warren Buffett has made several high-profile investments and acquisitions that have significantly contributed to his wealth and reputation. Some of his most notable investments include:

- Coca-Cola: Buffett began buying shares of Coca-Cola in 1988 and eventually became one of the company’s largest shareholders. He was drawn to Coca-Cola’s strong brand, global reach, and consistent earnings. The investment has been one of Berkshire Hathaway’s most successful, generating substantial returns over the years.

- American Express: In the 1960s, American Express faced a crisis when it was revealed that a subsidiary had engaged in fraudulent activities. The company’s stock plummeted, but Buffett saw an opportunity. He invested heavily in American Express, believing in the strength of its brand and the loyalty of its customers. The investment paid off and remains a core holding in Berkshire’s portfolio.

- Geico: Buffett first invested in Geico in the 1950s, attracted by the company’s unique business model and growth potential. He continued to increase his stake over the years and eventually acquired the entire company in 1996. Geico has since become one of Berkshire Hathaway’s most profitable subsidiaries.

- Apple: In 2016, Buffett made a surprising move by investing in Apple, a technology company. Historically, Buffett had avoided tech stocks due to their complexity and volatility. However, he saw Apple as more of a consumer products company with a strong brand, loyal customer base, and impressive cash flow. The investment has been extraordinarily successful, with Apple becoming one of Berkshire’s largest holdings.

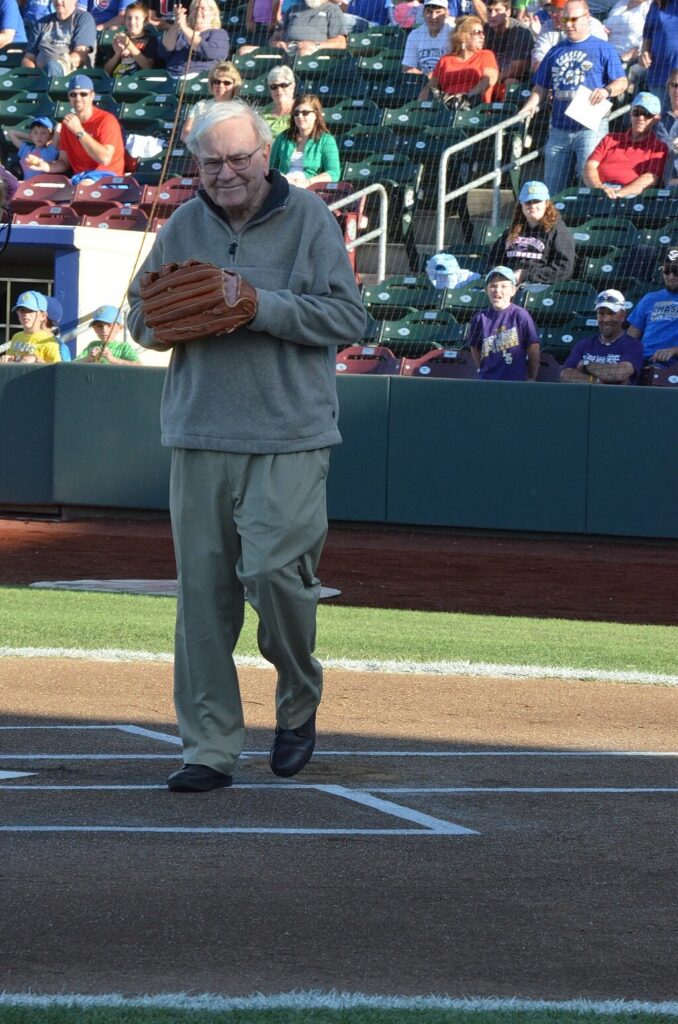

The Annual Shareholder Meetings

Warren Buffett’s annual shareholder meetings, often referred to as the “Woodstock for Capitalists,” are legendary. Held in Omaha, these meetings attract thousands of Berkshire Hathaway shareholders from around the world. The meetings provide a rare opportunity for investors to hear directly from Buffett and Munger, who answer questions and share their insights on a wide range of topics, including the economy, investing, and business management.

The meetings are known for their candid and informal atmosphere. Buffett and Munger’s humor, wisdom, and straightforwardness have made these events a must-attend for serious investors. The meetings are also an opportunity for shareholders to learn more about Berkshire’s diverse portfolio of companies and the management teams that run them.

Philanthropy and the Giving Pledge

Warren Buffett is not only known for his financial acumen but also for his commitment to philanthropy. In 2006, he made a historic pledge to donate the majority of his wealth to charitable causes. He announced that he would give away 85% of his Berkshire Hathaway stock to five charitable foundations, with the largest portion going to the Bill and Melinda Gates Foundation.

Buffett’s philanthropic philosophy is guided by the belief that wealth should be used to improve the lives of others. He has often stated that he believes in giving his children “enough money so that they can do anything, but not so much that they can do nothing.” His donations have supported a wide range of causes, including global health, education, poverty alleviation, and women’s rights.

In 2010, Buffett, along with Bill and Melinda Gates, launched the Giving Pledge, an initiative that encourages the world’s wealthiest individuals to commit to giving away the majority of their wealth to philanthropic causes. The Giving Pledge has attracted signatories from around the world, all of whom have pledged to use their wealth to make a positive impact on society.

Personal Life and Legacy

Despite his immense wealth, Warren Buffett is known for his modest lifestyle. He still lives in the same house in Omaha that he purchased in 1958 for $31,500, and he is known for his frugality and down-to-earth demeanor. Buffett’s humility and approachability have endeared him to millions of people around the world.

Buffett has three children, Susan, Howard, and Peter, from his first marriage to Susan Thompson, who passed away in 2004. In 2006, he married his longtime companion, Astrid Menks. Despite his busy schedule, Buffett has maintained close relationships with his family and is known for his love of bridge, which he plays regularly.

Buffett’s legacy extends far beyond his financial success. He is widely respected for his integrity, wisdom, and commitment to ethical business practices. His annual letters to Berkshire Hathaway shareholders are studied by investors and business students alike for their insights into economics, management, and life.

The Future of Berkshire Hathaway

As Warren Buffett has aged, speculation about the future of Berkshire Hathaway has increased. Buffett has been open about succession planning, stating that the company has a plan in place for when he is no longer able to lead. While he has not publicly named his successor, it is widely believed that Greg Abel, who oversees Berkshire’s non-insurance operations, is the most likely candidate.

Buffett has expressed confidence in the future of Berkshire Hathaway, emphasizing that the company’s decentralized structure and strong management teams will ensure its continued success. He has also noted that Berkshire’s culture of integrity and long-term thinking is deeply ingrained and will endure beyond his tenure.

Despite the uncertainty surrounding Buffett’s eventual departure, Berkshire Hathaway remains a powerhouse in the global economy, with a market capitalization of over $700 billion. The company’s diverse portfolio and sound investment principles continue to attract investors who believe in Buffett’s vision.

Conclusion

Warren Buffett’s life and career are a remarkable example of the power of patience, discipline, and a long-term perspective in investing. From his humble beginnings in Omaha to becoming one of the wealthiest individuals in the world, Buffett has remained true to his principles and has used his wealth to make a positive impact on society.

His legacy as the “Oracle of Omaha” is not only defined by his financial success but also by his commitment to philanthropy, his integrity, and his ability to inspire others. As one of the most respected and admired figures in the business world, Warren Buffett’s influence will be felt for generations to come!